- Example: A Bookstore's Sales Transaction

- 1. Customer Invoicing

- 2. Recording Transactions

- 3. Payment Tracking and Reconciliation

- Purpose of the Customer Follow-Up Report

- Key Features of the Report

- Usage in Business

- Template 1: Gentle Reminder (1-7 Days Overdue)

- Template 2: Second Reminder (8-14 Days Overdue)

- Template 3: Final Reminder (15+ Days Overdue)

Accounts receivable represents sales that have been made but not yet paid for in cash. Here’s a clearer explanation:

- Accounts Receivable: This is a balance sheet item that represents the amount of money owed to a company by its customers for goods or services delivered but not yet paid for. It’s an asset because it’s money the company expects to receive.

- Sales on Credit: When a company sells goods or services and allows the customer to pay later, this transaction is recorded as a sale (increasing the company’s revenue) and also as an account receivable (since the customer hasn’t paid yet).

- Recognition of Revenue: Under accrual accounting, a sale is recognized at the time the product is delivered or the service is performed, not necessarily when the cash is received. So, in financial statements, sales and accounts receivable are closely related – sales increase revenue, and the unpaid portion of those sales increases accounts receivable.

In summary, “Accounts Receivable is sales” typically means that the accounts receivable figure on the balance sheet partly represents sales that have been made but not yet paid for in cash.

Example: A Bookstore’s Sales Transaction

Scenario:

- Business: Bright Pages Bookstore

- Transaction: Bright Pages sells 100 books to a local school on credit.

- Price per Book: $15

- Total Sale Amount: 100 books x $15/book = $1,500

Accounting Entries:

- Record the Sale:

- Debit Accounts Receivable $1,500 (to record the amount owed by the school)

- Credit Sales Revenue $1,500 (to record the revenue from the sale of books)

- When Payment is Received (let’s say, a month later):

- Debit Cash $1,500 (to record the cash received)

- Credit Accounts Receivable $1,500 (to indicate that the school’s debt is cleared)

Explanation:

- When Bright Pages sells the books, they haven’t received the cash yet, but they’ve earned the revenue. So, they record the revenue in the Sales Revenue account.

- Simultaneously, Bright Pages records the amount the school owes them as Accounts Receivable, an asset on their balance sheet. This represents the expectation of receiving cash in the future.

- When the school eventually pays, Bright Pages records this as an increase in Cash and a decrease in Accounts Receivable, balancing the transaction.

Balance Sheet Impact:

- Before Payment: Bright Pages’ balance sheet shows an increase in Accounts Receivable by $1,500.

- After Payment: The Cash account increases by $1,500, and Accounts Receivable decreases by $1,500, reflecting the payment.

In this example, the Accounts Receivable initially appears as an increase in assets, indicating money owed to the bookstore. Once the payment is made, it is converted into cash, and the Accounts Receivable balance decreases accordingly.

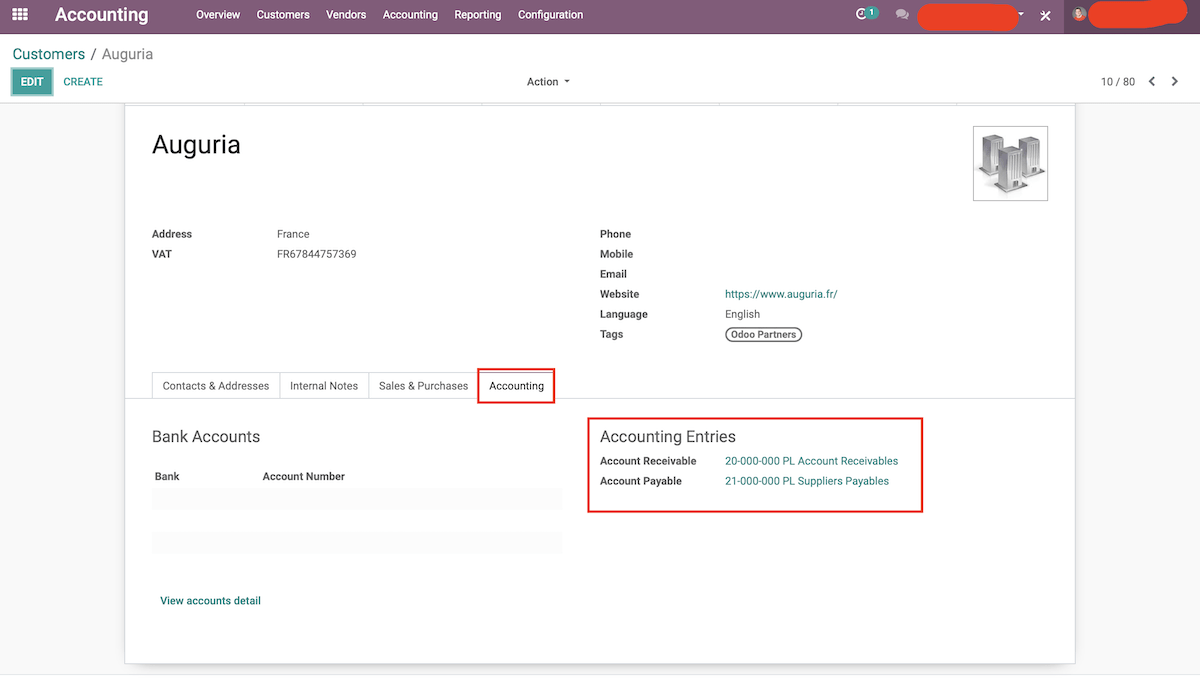

How does Odoo ERP manage customer’s Account Receivables?

Odoo ERP, like many Enterprise Resource Planning (ERP) systems, has a comprehensive approach to managing customer Accounts Receivable (AR). Here’s a general overview of how Odoo ERP might manage AR:

1. Customer Invoicing

- Creating Invoices: In Odoo, when a sale is made, an invoice is generated. This can be done automatically or manually, depending on the workflow set up in the system.

- Invoice Details: The invoice includes details like customer information, products or services sold, quantities, prices, and the total amount due.

- Sending Invoices: Invoices can be sent directly to customers via email through Odoo.

2. Recording Transactions

- Accounts Receivable Entry: Upon creating an invoice, Odoo records the amount in the AR account. This entry increases the AR balance, indicating the amount owed by the customer.

- Revenue Recognition: Simultaneously, revenue is recognized, reflecting the sale in the company’s financials.

3. Payment Tracking and Reconciliation

- Payment Tracking: Odoo tracks payments received against the specific invoices.

- Automatic or Manual Reconciliation: When payments are received, they are either automatically matched to the corresponding invoice or manually reconciled by the user. This process decreases the AR balance.

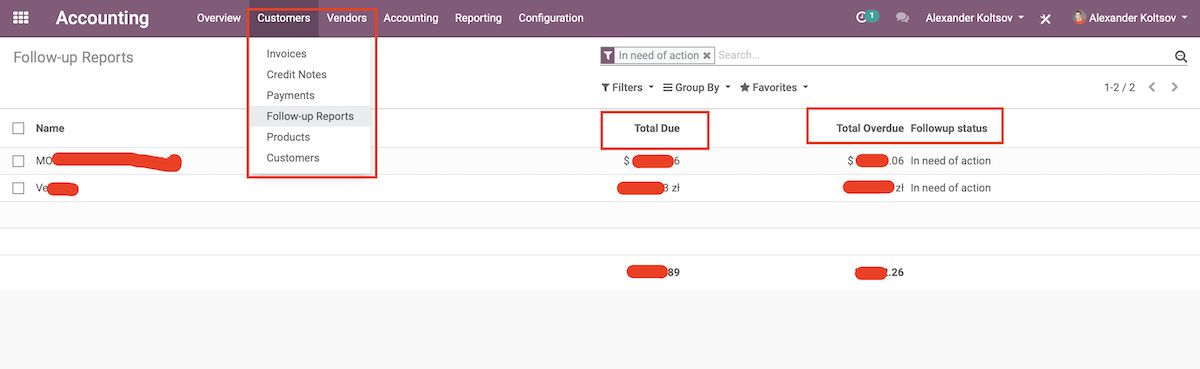

Customer Follow-Up Report (Due Payments)

A Customer Follow-Up Report, particularly in Odoo ERP is a tool used to track and manage interactions with customers regarding accounts receivable, overdue invoices, and other outstanding obligations. Here’s a detailed breakdown of what this report typically includes and its purpose:

Purpose of the Customer Follow-Up Report

- Identifying Outstanding Accounts: The report helps in identifying customers with overdue invoices or accounts receivable that haven’t been settled by the due date.

- Improving Cash Flow: By actively managing overdue accounts, businesses can improve their cash flow.

- Customer Relationship Management: It aids in maintaining positive customer relationships by ensuring communication about outstanding debts is consistent and professional.

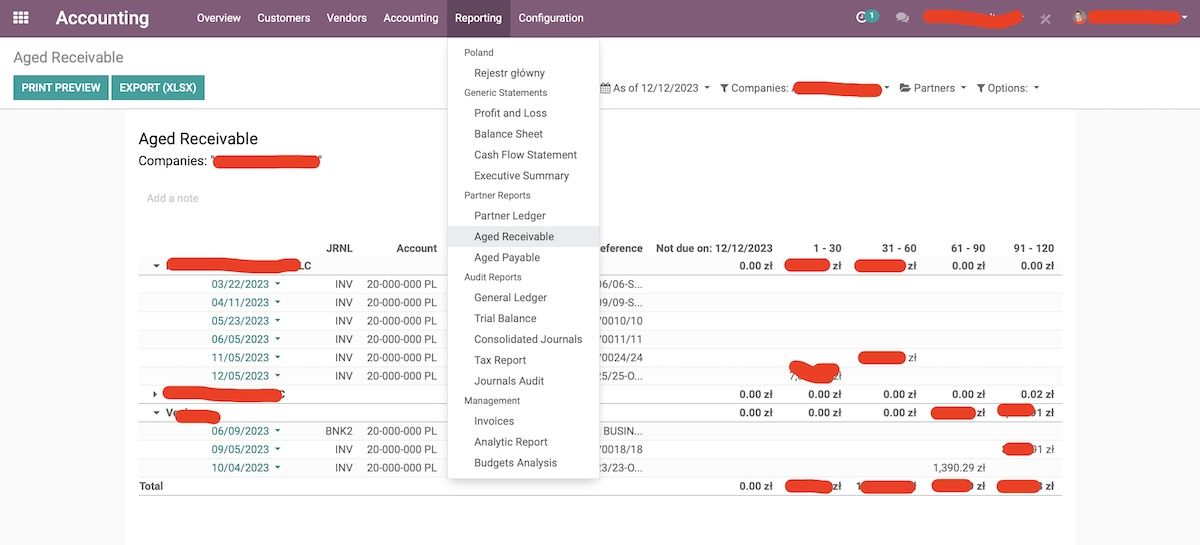

Key Features of the Report

- Customer Details: Includes customer name, contact information, and any relevant details necessary for follow-up.

- Invoice Information: Lists invoices that are overdue, including invoice numbers, dates, and amounts.

- Aging Summary: Categorizes overdue invoices based on how long they have been unpaid (e.g., 30 days, 60 days, 90 days overdue). This is crucial for prioritizing follow-up efforts.

- Payment History: Shows the customer’s payment history, providing insight into their payment behavior.

- Notes from Previous Follow-Ups: Includes notes or comments from previous communications with the customer regarding their outstanding balances.

- Action Required: Suggests or records the next steps for follow-up, whether it’s sending a reminder, making a phone call, or considering more serious collection measures.

Usage in Business

- Accounts Receivable Management: A key tool for the accounts receivable team to manage outstanding debts efficiently.

- Customer Service: Used by customer service teams to address any issues or disputes raised by customers about their invoices.

- Sales and Account Management: Helps in maintaining good customer relations and can be used by sales or account managers to address payment issues during regular interactions with customers.

The Customer Follow-Up Report is a vital component in managing a business’s cash flow and maintaining healthy customer relationships. It provides a structured and efficient approach to handling overdue accounts and ensures that efforts to collect unpaid debts are systematic and consistent.

Due Payment Reminder Templates

Template 1: Gentle Reminder (1-7 Days Overdue)

Subject: Friendly Reminder: Invoice [#InvoiceNumber] Due for Payment

Dear [Customer's Name],

I hope this message finds you well. I'm writing to remind you about the invoice [#InvoiceNumber] dated [Invoice Date], for [Product/Service Description], which was due for payment on [Due Date].

We understand that things can get busy, and this is just a gentle reminder. If you have already made the payment, please disregard this notice. Otherwise, we kindly request that your payment of [Amount Due] is completed at your earliest convenience.

You can make the payment using [Payment Methods] or contact us for any questions or if you need further assistance.

Thank you for your prompt attention to this matter, and we greatly appreciate your continued business.

Warm regards,

[Your Name]

[Your Position]

[Your Contact Information]

[Company Name]Template 2: Second Reminder (8-14 Days Overdue)

Subject: Friendly Reminder: Invoice [#InvoiceNumber] Due for Payment

Dear [Customer's Name],

I hope you are doing well. This is a second reminder regarding the outstanding payment for invoice [#InvoiceNumber] dated [Invoice Date]. As per our records, the amount of [Amount Due] remains outstanding and was due on [Due Date].

We would greatly appreciate your prompt action in settling this invoice. If there are any unforeseen circumstances or issues preventing the payment, please let us know, and we'd be happy to discuss any necessary arrangements.

For your convenience, payment can be made via [Payment Methods]. Your timely response to this matter is highly valued.

Thank you for your attention, and please feel free to reach out if you have any queries.

Best regards,

[Your Name]

[Your Position]

[Your Contact Information]

[Company Name]Template 3: Final Reminder (15+ Days Overdue)

Subject: Urgent: Final Reminder for Payment of Invoice [#InvoiceNumber]

Dear [Customer's Name],

I am writing to you regarding invoice [#InvoiceNumber] dated [Invoice Date], which is now [Number of Days Overdue] days overdue. The amount of [Amount Due] is yet to be settled, despite previous reminders.

As we value our relationship with you, we would like to resolve this matter amicably and avoid any further action. Please arrange for the payment to be made at your earliest convenience. If you are experiencing difficulties, we are more than willing to discuss possible solutions.

We hope to settle this matter promptly and continue our positive business relationship. Please do not hesitate to contact me directly if you have any concerns or require assistance.

Thank you for your immediate attention to this matter.

Sincerely,

[Your Name]

[Your Position]

[Your Contact Information]

[Company Name]Template 4: Several Invoices

Dear Sir/Madam,

Thank you for placing your order with <Company Name>!

Our records show that payment for this order is still due. Please find details below.

Please transfer your payment within 2 working days so that your products remain booked for you.

If the amount has already been paid, please disregard this notice.

Please contact your sales manager if you have any questions.

Thank you in advance for your cooperation.

Kind regards,

<due invoices list>