- Cash Flow Direct Method Plugin for Odoo ERP

Cash Flow Direct Method Plugin for Odoo ERP

ERPixel introduces the Direct Method Cash Flow Plugin

ERPixel has developed a plugin for companies that want to manage their cash flow using the Direct Method.

This plugin extends Odoo ERP with true cash-based reporting and treasury control tools that are missing in the standard system.

Main features include:

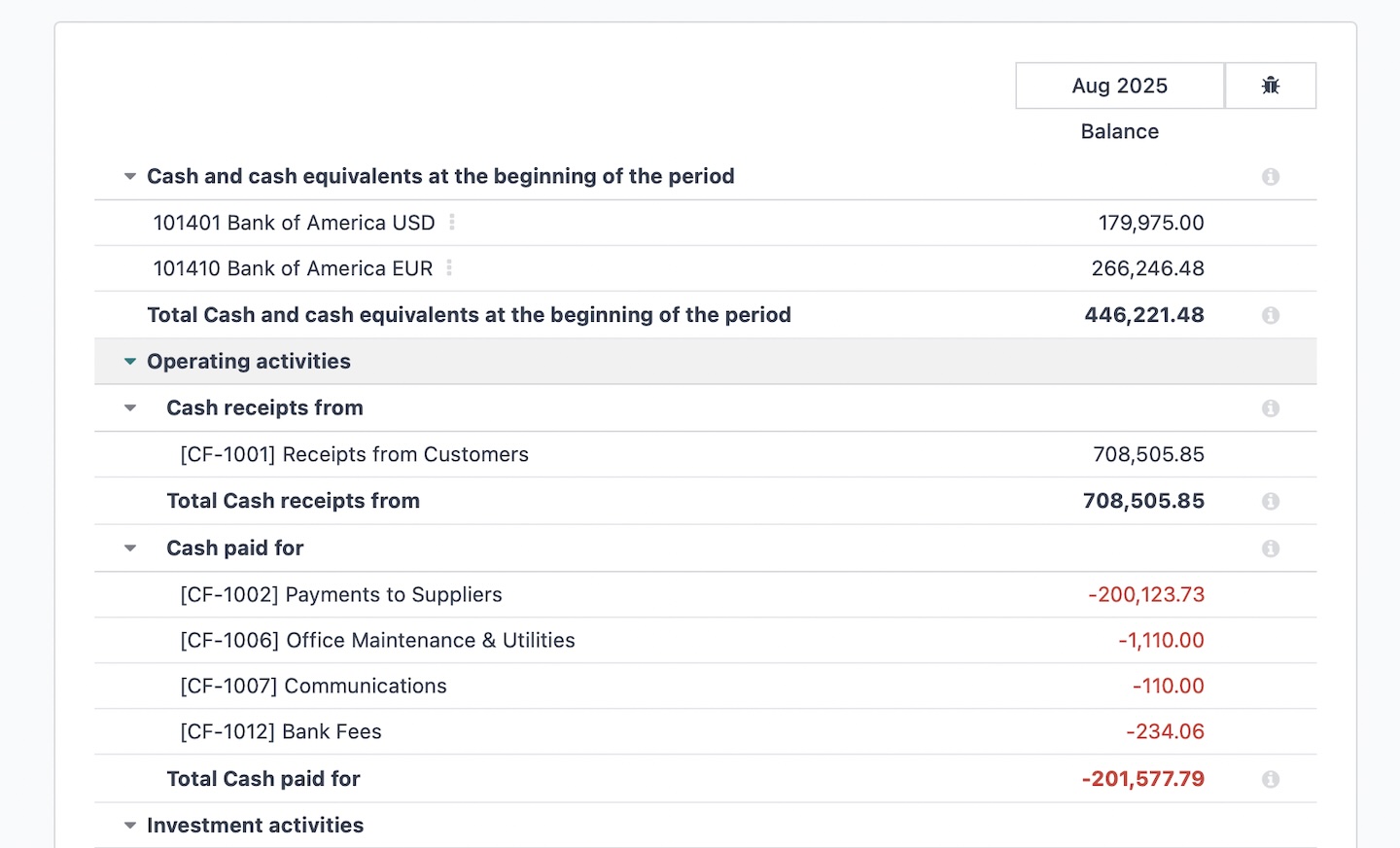

- A new Cash Flow Direct Method report based on real bank transactions.

- Ability to define and manage a list of Cash Flow accounts.

- Supports multi-company consolidation, allowing unified cash flow visibility across several legal entities.

- Grouping of accounts into categories: Operational, Investment, Financial, and Other Activities.

- Enhanced reconciliation models supporting the new logic.

- Mandatory Cash Flow account when validating bank statements — ensuring accurate tracking.

Key benefits:

- Fully compatible with Odoo Enterprise Edition v16–v19.

- Quick setup — just configure your Cash Flow account list.

- Works seamlessly with Reconciliation Models to speed up routine bank processing.

- Integrates with other ERPixel solutions: Cash Flow Budgeting and Payment Requests.

- Supported and customizable by ERPixel’s implementation team.

Request CashFlow Direct Now!

The plugin is free for ERPixel customers under an active Customer Support Agreement.

The Challenge of Tracking Cash

For growing businesses, tracking real-time cash movements is essential. However, there are two fundamentally different ways to generate a Cash Flow Statement:

- Direct Method — based solely on actual cash transactions, such as bank statements. This is the preferred method for daily cash monitoring and treasury control.

- Indirect Method — based on accrual records, such as invoices and vendor bills, requiring reconciliation to reflect actual payments.

⚠️ Odoo ERP does not support the Direct Cash Flow Statement out-of-the-box. This poses a serious challenge for companies that need real-time liquidity tracking.

Imagine this real-world scenario: this morning your company received 2,000,000 and paid 1,800,000 to suppliers. You haven’t issued or received invoices yet. Only a Direct method report can show you this cash position. But in standard Odoo, you’re blind to this.

To solve this, ERPixel has developed an Advanced Cash Flow Statement Direct plugin, extending Odoo’s core accounting capabilities.

🔢 Indirect Method in Odoo: Standard Functionality

Odoo provides the Cash Flow Statement based on the indirect method, accessible through the Accounting app → Reporting → Cash Flow Statement.

How It Works

- Data comes from accounting entries (

account.move.line) tagged as:receivable(customer invoices)payable(vendor bills)- other non-liquidity transactions

- Based on these entries, Odoo builds the operating, investing, and financing sections.

- Reconciliation is crucial to reflect whether an invoice has been paid or not.

What the User Must Do

- Post all customer invoices and vendor bills.

- Perform reconciliation with payments (bank/cash).

- Assign proper Cash Flow Tags to all involved accounts.

Key Warning

If an account does not have a tag (Operational / Financial / Investment), the system will list entries under “undefined” in the report — a sign of incorrect configuration.

Tag Setup Guidance

Before generating the report:

- Tag all income and expense accounts.

- Tag receivable/payable accounts.

- Validate the tag consistency via the Cash Flow report filters.

🪡 Direct Method: What Odoo Lacks (And ERPixel Adds)

What Is the Direct Method?

- It uses only liquidity-type entries (bank, cash, credit card).

- Ideal for daily cash visibility, regardless of invoice issuance.

- Simple and objective: it reflects actual movements, not planned revenue or expenses.

Why Standard Odoo Fails

- Odoo does not group or report liquidity transactions by Cash Flow category (without manual work).

- There is no way to assign tags to liquidity accounts for Cash Flow reporting.

- No report exists to show today’s cash movement by category (e.g. supplier payments vs loan payments).

What ERPixel Built

- Our plugin processes only liquidity entries.

- Assigns Cash Flow types to incoming/outgoing bank transactions.

- Enables full Direct Method Cash Flow Statement, usable daily or weekly.

📊 Technical Notes for Accountants

- Odoo stores all movement data in

account.move.linerecords. - Reconciliation links liquidity entries with payables/receivables via a residual amount.

- If 800 was paid against a 1000 invoice, the residual amount is 200.

Interface Navigation

- Report: Accounting → Reporting → Cash Flow Statement

- Filters: Dates, Journals, Companies, Cash Flow Tags

- Additional reports may appear depending on localization (e.g. Poland, UAE)

What cash flow software to connect to Odoo?

If you are searching for “what cash flow software to connect to Odoo”, one of the most effective options is to use a cash flow module built specifically for Odoo rather than a separate external tool. External systems require integrations, data synchronization, and manual workarounds, while a native Odoo-based module works directly with invoices, bank statements, and vendor payments.

ERPixel provides a Cash Flow module designed for real operational cash control inside Odoo. It calculates cash flow using the direct method, supports budgeting of inflows and outflows, and includes a full Payment Request and approval workflow. Because it is deeply integrated with Odoo Accounting and multi-company environments, the forecast remains accurate and traceable without exporting data to spreadsheets or connecting third-party systems.

🚀 Final Thoughts

The Cash Flow Statement in Odoo is powerful when used correctly. However:

- The Indirect Method is useful for end-of-period reports but requires full reconciliation.

- The Direct Method, critical for operational cash control, is missing in Odoo.

ERPixel’s Cash Flow Direct plugin closes this gap and enables precise, real-time financial control.

✨ Contact ERPixel to learn more or request a demo of the Direct Cash Flow Module.